Energy

Reduce energy overheads with more effective procurement and management solutions.

Complete control

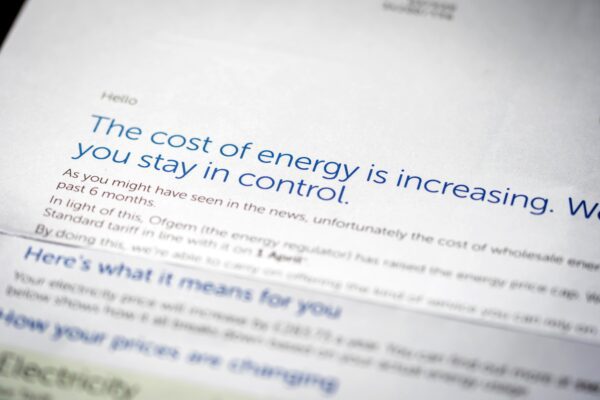

With prices for electricity, gas and other fuels expected to face more unpredictability in the coming years, taking control of how you buy, account for and optimise your energy is critical.

As the UK’s leading energy consultancy, our experts can offer comprehensive support in all your energy needs. Whether you want to build a procurement strategy, manage your costs or become more energy efficient, Inspired’s energy consultants are here to support you.

Managing costs and compliance

Fluctuations in the price of electricity, gas and other fuels can dramatically affect business success. As such, many organisations now see energy as a key part of their overall business strategy.

An effective energy strategy reduces corporate risk, improves sustainability credentials and boosts commercial resilience, protecting your bottom line and supply chain partnerships.

Our suite of cost management and compliance solutions include:

Whether you are trying to improve budget, price optimisation, or another combination of objectives, our team of market analysts, risk managers and assurance analysts can secure the right solution for your organisation.

Reducing consumption

With fluctuating market volatility and increasing non-commodity charges, there’s never been a better time to control and reduce energy consumption.

It’s crucial you can see where and why you’re using energy so that you can make informed decisions to improve energy efficiency and ultimately cut costs. You can also reduce grid dependency through on-site and off-site renewable technology, which help to stabilise your costs and reduce your carbon emissions.

We have a range of energy management solutions to help you meet your commercial goals:

From our insights

Climate Change Levy (CCL) Rates Are Increasing from April 2024

From the 1st of April 2024, there will be changes to the Climate Change Levy (CCL) impacting the main and discount rates for gas and solid fuels. …

ESOS Phase 3 – Compliance Notification Enforcement Extension

The Environment Agency has announced that the new ESOS compliance reporting system will go live on 19th March 2024….

Energy in Spring Budget 2024

On 6 March Chancellor Jeremy Hunt presented his Spring Budget to the House of Commons. Let’s look at some of the energy and sustainability …

Get in touch

If you would like to know more about how our carbon services can support your efficiency and reduction plan, then please submit the form to speak to one of our experts.